Best Tax Deductions For Businesses

Staying current on tax changes is one of the most effective ways for business owners to protect their bottom line. In 2025, inflation adjustments, new IRS reporting rules, and expanded sustainability incentives are reshaping the tax landscape. Understanding these shifts allows you to take advantage of new deductions, credits, and strategies while avoiding compliance pitfalls.

This year’s tax changes include inflation-driven updates to brackets and standard deductions, which could lower your tax rate or qualify you for additional credits if you’re self-employed or running a small business. At the same time, stricter IRS documentation requirements mean you’ll need precise records for expenses like travel, meals, and payments through third-party platforms. Additionally, legislation promoting energy efficiency and sustainability continues to expand, offering direct tax savings for businesses investing in eco-friendly upgrades.

Proactive planning is more important than ever. By staying ahead of these changes and positioning your business to take full advantage of available tax breaks, you can improve cash flow, remain compliant, and build a foundation for long-term profitability.

2025 Tax Brackets and Rates

The IRS adjusts tax brackets and deduction thresholds annually to account for inflation, and 2025 brings several changes that could impact your business’s tax obligations. If you operate as a pass-through entity, such as an S corporation or LLC, these updates may position more of your revenue into lower brackets, reducing your taxable income.

While the federal corporate tax rate remains around 21% for traditional C corporations, inflationary increases to wage bases could affect payroll taxes.

Here’s what you need to keep in mind:

- Pass-Through Entities: Updated thresholds may affect your eligibility for deductions like the qualified business income (QBI) deduction, offering potential tax savings.

- Corporate Tax Rates: C corporations will continue to pay a flat 21% rate federally, but state-level changes or excise tax adjustments may add complexity.

- Payroll Taxes: Inflation-driven increases to Social Security and Medicare wage bases could mean higher employer contributions, especially if you manage payroll for multiple employees.

- Self-Employment Taxes: Entrepreneurs paying employer and employee portions of Social Security and Medicare taxes should expect a slightly higher liability.

- Action Steps: Monitor IRS updates regularly and consult a tax advisor to optimize your tax strategy and avoid surprises in 2025.

New IRS Reporting Requirements

Alongside changes to tax brackets, 2025 sees important updates in how businesses must report certain income and expenses. The threshold for issuing a 1099-K, for instance, is now lower. Even if you only process modest amounts of online or credit card sales through platforms like PayPal or Venmo, you may receive a 1099-K that you’ll need to reconcile on your tax return. Properly reporting small transactions will help you avoid any red flags or discrepancies that could trigger an audit.

Deduction rules for travel, meals, and related expenses continue tightening. You may need to keep detailed logs that specify dates, amounts spent, and the business purpose of each expense. While more time-consuming, this approach ensures that you can substantiate every claim if the IRS looks closely at your return. In this environment, adopting electronic record-keeping systems, scanning receipts immediately, and maintaining real-time expense logs can offer peace of mind and reduce stress during tax season.

7 Must-Know Small Business Deductions for 2025

Small business owners have several opportunities to lower their taxable income in 2025. These deductions cover essential expenses like workspace, supplies, travel, and insurance, making them critical for managing costs effectively. Proper documentation is key to maximizing these benefits while ensuring IRS compliance.

Key deductions include:

- Home Office: For a dedicated home workspace used exclusively for business, claim $5 per square foot, up to 300 square feet ($1,500 max).

- Commercial Rent: You can fully deduct rent for office or retail space outside your home, but not in combination with the home office deduction.

- Office Supplies and Technology: Deduct items like paper, software, and equipment used solely for business.

- Phone and Internet: Deduct the business-use portion of bills; track usage to determine the deductible percentage.

- Business Insurance: Fully deduct premiums for liability, property, workers’ compensation, and other necessary policies.

- Travel: Deduct transportation, lodging, and 50% of business meal expenses with detailed receipts and itineraries.

- Mileage: Deduct $0.70 per mile or vehicle expenses (e.g., gas, maintenance) for business driving.

Energy-Efficient and Sustainability Credits

Legislation passed in recent years includes expanded or renewed credits for businesses that invest in energy-efficient technology. If you install solar panels or purchase electric vehicles for your commercial fleet, you might qualify for significant credits that come off your tax bill dollar-for-dollar.

These programs often require precise documentation, such as invoices and certifications proving energy efficiency. In addition to the federal offerings, some states have parallel or additional incentives, so you might want to investigate localized rebates or tax credits that can increase your total savings.

Retirement Contributions and Health Insurance Premiums

Retirement accounts remain a powerful tool for reducing taxable income while setting money aside for the future. Solo 401(k)s, SEP-IRAs, and SIMPLE IRAs each have specific contribution limits, which could be significantly higher in 2025 than in previous years. If you are both the employer and employee, you may be able to contribute tens of thousands of dollars, lowering your adjusted gross income.

Health insurance premiums for the self-employed can also be taken as an adjustment to income. This can particularly help if you are a sole proprietor or a partner in an LLC, though you must ensure you are not eligible for a subsidized plan elsewhere, such as through a spouse’s employer. Sometimes, S corporation shareholder-employees may also claim this deduction, but it must be structured correctly in your payroll and business documentation.

Top Small Business Credits to Leverage

Tax credits are a powerful tool for reducing your business’s tax liability in 2025. These credits directly lower the amount of taxes you owe, offering significant savings for eligible expenses or initiatives. Whether hiring employees, improving processes, or supporting your workforce, these credits can make a big difference. Here are some of the most impactful options to consider:

- Work Opportunity Tax Credit (WOTC): Earn between $2,400 and $9,600 for each employee hired from targeted groups, such as veterans, long-term unemployed individuals, or ex-felons.

- Research and Development (R&D) Tax Credit: Qualify for credits by improving products, processes, or technology—even if your work isn’t part of large-scale R&D projects.

- Disabled Access Credit: Receive up to $5,000 annually for making your business accessible to individuals with disabilities by installing ramps, widening doorways, or adding adaptive equipment.

- Small Business Health Care Tax Credit: Businesses with fewer than 25 full-time employees that cover at least 50% of health insurance premiums can claim a credit of up to 50% of those costs.

- Employer-Provided Childcare Facilities Credit: Offset up to $150,000 for onsite childcare services or other employee benefits.

Startup, Relocation, and Business Losses

New ventures established in 2025 can deduct a portion of their startup costs, including fees paid to consultants or for market research, up to five thousand dollars. If you spend more than that, the rest is typically amortized over 15 years. Similarly, if you need to relocate your corporation or LLC a certain distance, you might write off transport, packing, and associated costs, provided you meet the time and location criteria.

While showing a business loss can be stressful, it is generally allowed if you intend to earn a profit. If you experience consecutive losses, take extra care to demonstrate that your enterprise isn’t just a hobby. Maintaining meticulous records of your revenue-building activities can help you defend any losses to the IRS and keep your deductions intact.

State and Local Tax Changes in 2025

Beyond federal mandates, many states offer unique deductions or credits to encourage small business growth or sustainability measures. A new state program might boost your bottom line if you’re expanding into energy-efficient equipment or setting up shop in targeted redevelopment areas.

Additionally, sales tax regulations continue to evolve, especially with the growth of e-commerce. If you operate in multiple jurisdictions, you might need automated software solutions to ensure accurate collection and remittance of sales tax to each state’s revenue agency.

Best Practices in Record-Keeping and Reporting

With the IRS enforcing stricter documentation standards, effective record-keeping is no longer optional—it’s essential. Organized records can simplify tax preparation, support your deductions and credits, and help you avoid penalties in case of an audit. Digital tools, such as cloud-based storage and accounting platforms, can streamline the process, making tracking and retrieving records easier when needed. Preparing for a possible audit or tax inquiry ensures you’re not caught off guard.

Key record-keeping practices include:

- Digital Receipt Storage: Scan or photograph receipts and store them in cloud-based systems for quick and reliable access during tax preparation or audits.

- Mileage and Expense Logs: Maintain detailed logs for business-related travel, meals, and other deductible expenses, noting dates, purposes, and amounts.

- Digital Accounting Tools: Use platforms like QuickBooks or Xero to track income, expenses, and sales tax in a single, organized system.

- Audit Preparedness: Retain documentation for all major claims, such as new hires qualifying for tax credits or large equipment purchases eligible for deductions.

- Estate Planning Records: If you’re considering passing on assets or ownership, keep detailed records of trusts, gifts, and succession strategies to reduce estate tax exposure effectively.

Tax Planning for a Profitable 2025

The 2025 tax environment brings both opportunities and challenges. Inflation adjustments could lower your tax bracket, while expanded credits for energy-efficient investments offer significant savings. However, stricter IRS reporting rules mean detailed record-keeping is more critical than ever to stay compliant and avoid penalties.

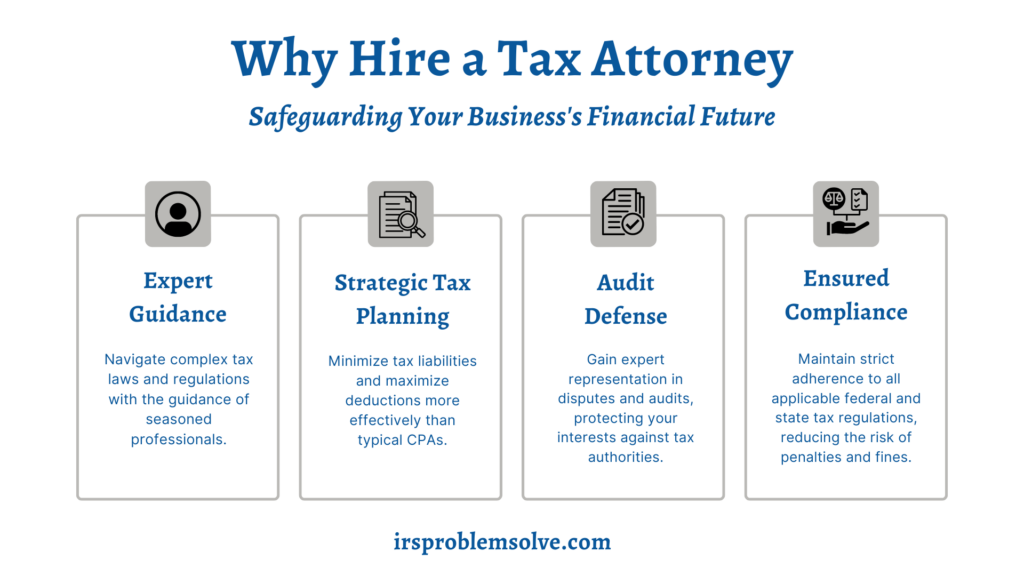

As an experienced tax attorney, I can help you take full advantage of these changes. A proactive approach locks in deductions optimizes credits and sets your business up for long-term success.

Don’t wait—schedule a consultation with me, Todd Unger, to create a customized 2025 tax plan. Together, we’ll maximize your savings and ensure compliance.