What is the Statute of Limitations?

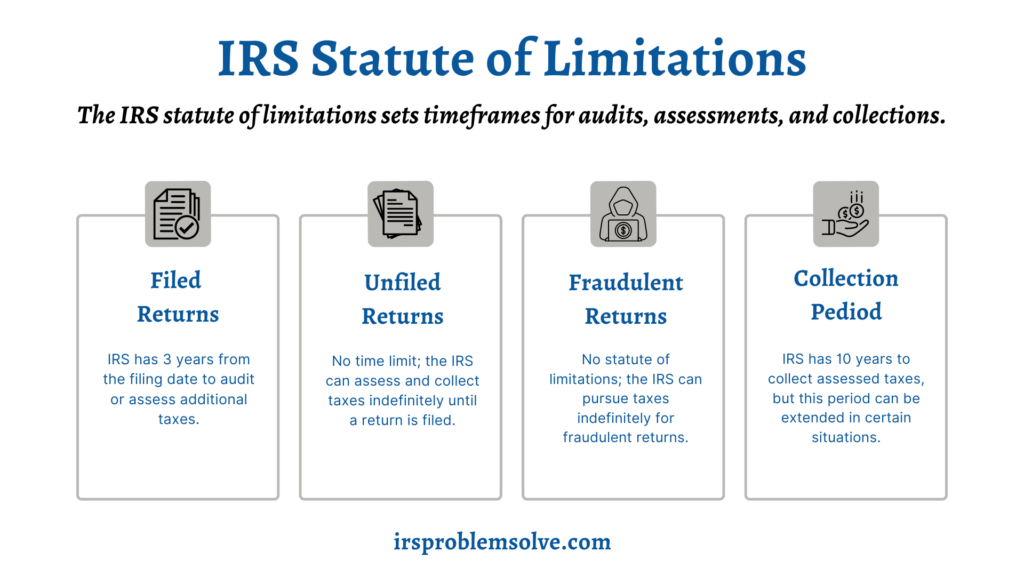

The statute of limitations is a legal time limit within which the IRS can audit tax returns, assess additional taxes, or collect unpaid taxes. Generally, for filed tax returns, the IRS has three years from filing to conduct an audit and ten years from the assessment date to collect any unpaid taxes. However, the statute of limitations does not begin if a tax return is not filed, meaning the IRS can pursue tax collection indefinitely.

This indefinite period applies to unfiled returns, giving the IRS the authority to assess and collect taxes at any time without restriction. This emphasizes the critical importance of filing timely tax returns to limit potential exposure to audits and collections.

IRS Policy on Unfiled Tax Returns

IRS Policy Statement 5-133 mandates that taxpayers generally file six years of back tax returns to be considered in good standing with the IRS. This policy ensures compliance while providing a manageable timeframe for taxpayers to catch up. However, the IRS may require returns beyond the typical six years in specific situations, such as when there is a substantial potential tax liability, involvement of business returns with significant discrepancies, or if a revenue officer is conducting an in-depth investigation.

These exceptions highlight the IRS’s commitment to thorough tax enforcement and underscore the importance of addressing all unfiled returns, regardless of age, to avoid potential legal and financial consequences.

Consequences of Not Filing Tax Returns

Consequences of Not Filing Tax Returns

Failing to file tax returns can result in severe consequences, including civil and criminal penalties. These penalties can significantly increase the amount owed and can even lead to criminal charges in extreme cases. Additionally, interest and late payment penalties accrue over time, compounding the total debt. The IRS may also file substitute returns on your behalf, which do not account for exemptions or deductions, often leading to a higher tax liability.

Here are the key points to consider:

- Civil and Criminal Penalties: Non-filing can lead to hefty fines and, in severe cases, criminal charges such as tax evasion.

- Interest and Late Payment Penalties: Interest accumulates on unpaid taxes from the due date, and failure-to-pay penalties can reach up to 25% of the tax owed.

- IRS-Imposed Substitute Returns: The IRS can file returns for you, often resulting in a higher tax bill as they won’t include exemptions or deductions you might be eligible for.

Exceptions to the Statute of Limitations

In cases of fraudulent returns or failure to file, the IRS is not bound by the usual statute of limitations and can go back more than six years to assess and collect taxes. Fraudulent returns involving intentional deceit to evade taxes eliminate the time limit for IRS action, allowing indefinite pursuit of owed taxes.

Similarly, if a taxpayer fails to file a return, there is no statute of limitations, giving the IRS the authority to assess taxes at any time. Other exceptions include significant underreporting of income, where the IRS can extend the audit period to six years if the omitted income is more than 25% of the gross income reported.

The Ten-Year Collection Rule

The Ten-Year Collection Rule

The IRS has a ten-year statute of limitations for collecting assessed taxes, starting when the tax is officially evaluated. To recover the owed taxes, the IRS has ten years to pursue collection actions, such as liens, levies, or wage garnishments. However, certain actions and circumstances can extend this collection period.

For instance, filing for bankruptcy, submitting an Offer in Compromise, or entering into an installment agreement can pause, or toll, the ten years, effectively extending the time the IRS has to collect the debt. Additionally, if a taxpayer leaves the country for an extended period, the clock may stop, resuming only when the taxpayer returns.

Steps to Take if You Have Unfiled Returns

To get back on track with your taxes, start by confirming the years you need to file, use IRS transcripts to check your income, and submit any overdue returns. If you owe taxes, setting up a payment plan with the IRS can make it more manageable.

Follow these steps for guidance:

- Confirming the Number of Unfiled Returns: Contact the IRS directly or have your tax professional use a dedicated hotline to determine how many years of returns you need to file.

- Using IRS Transcripts to Verify Income: Request wage and income transcripts from the IRS to ensure your returns accurately reflect all reported income and match IRS records.

- Filing Delinquent Returns: Prepare and file all overdue tax returns, ensuring they are complete and accurate to avoid further scrutiny and penalties.

- Setting Up Payment Plans with the IRS: If you owe taxes and cannot pay in full, negotiate a payment plan with the IRS to spread out your tax debt over time, making it more manageable.

- Requesting Penalty Abatement: If eligible, ask the IRS to waive failure-to-file or failure-to-pay penalties through first-time abatement or by demonstrating reasonable cause for late filings.

Need Professional Help?

Need Professional Help?

Tax professionals are crucial in handling unfiled returns by providing expert guidance, ensuring accurate filings, and negotiating with the IRS on your behalf. Their knowledge of tax laws and IRS procedures helps avoid costly mistakes and potential penalties. You can confidently navigate complex tax issues, establish manageable payment plans, and seek penalty abatements with professional assistance.

For personalized and effective support in resolving your tax matters, reach out to Todd S. Unger, Esq., LLC, and let our expertise work for you.