Stop Wage Garnishment Immediately

Wage garnishment, a complex legal process, is a significant financial mechanism. It is invoked as a last resort when other debt collection methods fail. It is crucial to understand this process, as it involves a court or government agency mandating an employer to withhold a portion of an individual’s earnings to repay outstanding debts, such as unpaid loans, child support, taxes, or other financial obligations. Legal guidelines determine the amount that can be garnished, ensuring the individual retains enough income to meet basic living expenses.

The process begins when a creditor files a request for garnishment in court. If granted, a writ of garnishment is issued to the debtor’s employer. This writ legally binds the employer to send the specified portion of the employee’s earnings directly to the creditor, thus bypassing the debtor’s direct control over a portion of their income.

Know Your Rights

The Consumer Credit Protection Act (CCPA) plays a crucial role in protecting individuals from excessive wage garnishment. It sets federal guidelines that cap the amount that can be garnished from an individual’s earnings, ensuring that the debtor retains sufficient income to live on. Under the CCPA, garnishments cannot exceed 25% of a person’s disposable income (the amount remaining after mandatory deductions like taxes and Social Security) or the amount by which a person’s weekly income exceeds 30 times the federal minimum wage, whichever is less.

Moreover, for debts like child support and alimony, up to 50-60% can be garnished if the debtor is not supporting another child or spouse, and an additional 5% can be taken for payments more than 12 weeks in arrears.

Additionally, each state may have its own laws that provide further protections; for example, some states offer lower garnishment caps or exemptions for certain types of workers or debts, thereby creating additional layers of protection beyond federal stipulations.

Preventive Measures

Preventive Measures

Proactive financial management is key to avoiding debt. It involves practical strategies to maintain economic stability and prevent financial crises. Here’s how:

- Budgeting:

- Create a detailed budget that tracks all income and expenses.

- Prioritize essential spending and aim to reduce discretionary expenses.

- Regularly review and adjust your budget to adapt to financial changes or goals.

- Emergency Savings:

- Establish an emergency fund that covers at least three to six months of living expenses.

- Save consistently, even in small amounts, to build this fund over time.

- Keep the emergency fund in a separate, easily accessible account to avoid unnecessary spending.

- Monitoring Finances:

- Check your credit report annually to ensure accuracy and detect fraudulent activities.

- Use financial apps or tools to monitor accounts and receive alerts about unusual activities.

- Review bank statements and financial accounts regularly to keep track of spending and savings progress.

Negotiating with Creditors

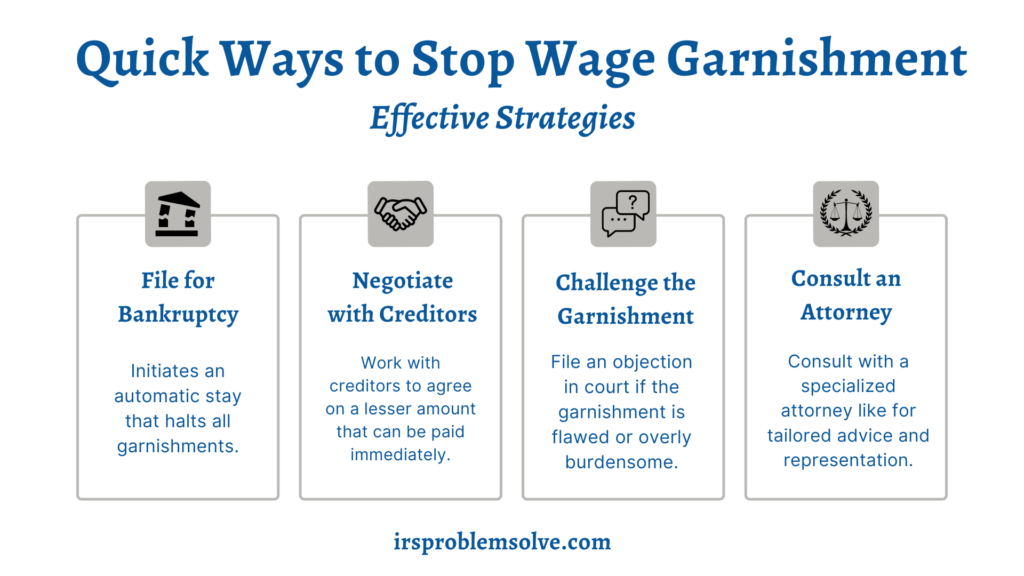

Approaching creditors for negotiations involves a strategic and informed approach, especially when proposing a feasible payment plan to manage outstanding debts. Start by thoroughly understanding your financial situation; this includes gathering all financial documents and preparing a clear overview of your income, expenses, and debt obligations.

When you contact your creditors, be honest about your financial difficulties and propose a payment plan that realistically reflects your ability to pay. It’s key to offer a plan that not only appeases the creditor but is also sustainable over the long term, potentially including reduced or extended payments.

If direct negotiation seems daunting or complex, consider enlisting the help of debt settlement companies or credit counseling services. These organizations specialize in negotiating with creditors on behalf of consumers, often having established relationships with creditors and experience in securing favorable terms. However, it’s important to research and select reputable services, as some may charge high fees or not act in your best financial interests.

Legal Actions to Challenge Garnishment

Legal Actions to Challenge Garnishment

Here’s a concise step-by-step guide to filing an objection to a wage garnishment, understanding the role of legal representation, and using a wage garnishment calculator:

- Review the Notice: Carefully read the garnishment documents to understand the details and deadlines.

- Gather Documentation: Collect all relevant financial documents, including pay stubs and evidence of expenses or hardships.

- Seek Legal Advice: Consult with a lawyer specializing in debt collection to explore your legal options and ensure your response is appropriately structured.

- Draft Your Objection: Write a formal objection stating your reasons, such as incorrect garnishment amounts or financial hardship.

- File and Serve: File the objection with the court and serve a copy to the creditor and any related parties as required by law.

- Attend the Hearing: If scheduled, attend the court hearing and be prepared to argue your case with all supporting documents.

- Use a Garnishment Calculator: Input your pay details into a wage garnishment calculator to determine the allowable amount based on your disposable income.

Bankruptcy as a Last Resort

Chapter 7 and Chapter 13 bankruptcy are legal processes that offer relief to individuals overwhelmed by debt. Chapter 7, known as liquidation bankruptcy, allows for the discharge of most unsecured debts by liquidating the debtor’s assets; this process is typically swift, concluding within a few months. Chapter 13, often called the wage earner’s plan, enables individuals with regular income to restructure their debt payments over three to five years, potentially allowing them to keep their property.

Filing for either type of bankruptcy immediately activates an “automatic stay,” which halts all collection activities, including wage garnishment, giving debtors temporary relief from creditors.

However, the long-term implications of declaring bankruptcy are significant. They severely affect the debtor’s credit score and remain on their credit report for up to 10 years for Chapter 7 and 7 years for Chapter 13. This can impact the ability to obtain future credit, secure housing, or even employment, necessitating careful consideration before filing for bankruptcy.

Benefits of Hiring an Attorney

Benefits of Hiring an Attorney

Working with an experienced lawyer like Todd S. Unger when facing wage garnishment can provide crucial advantages. Todd S. Unger’s expertise in tax law and debt-related legal issues ensures that clients receive knowledgeable guidance through the complexities of wage garnishment.

This professional assistance not only helps effectively stop wage garnishments but also negotiates feasible repayment plans and potentially reduces overall debt obligations.

What do you have to lose, contact Todd now!