Protecting and Advancing Small Businesses

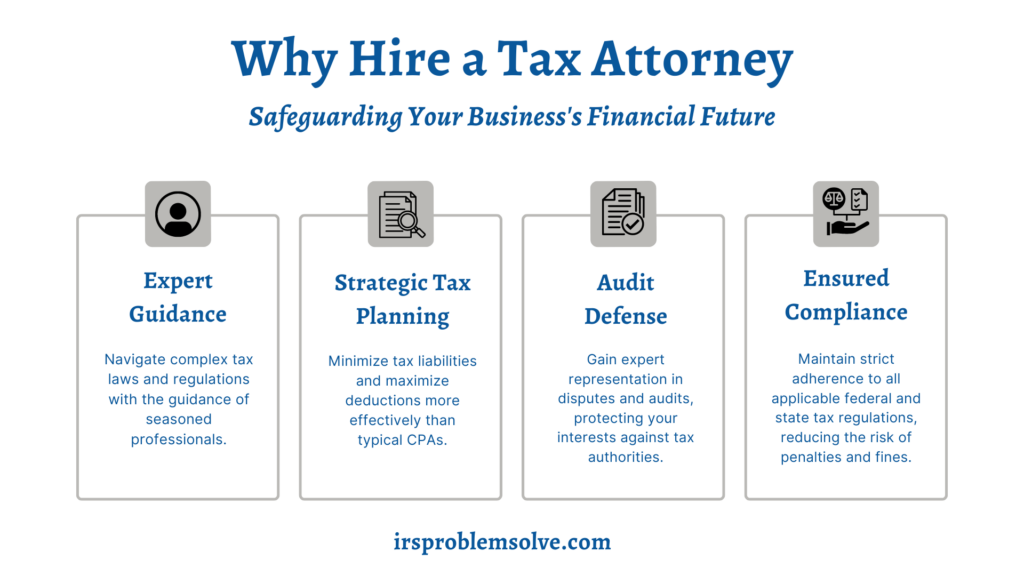

Tax attorneys play a pivotal role in small business management, offering security and confidence through their specialized legal expertise in tax law. These professionals ensure compliance with complex regulations, safeguard against legal pitfalls, and provide strategic tax planning to minimize liabilities and maximize benefits, giving small business owners peace of mind.

While Certified Public Accountants (CPAs) are indispensable for daily financial record-keeping, tax preparation, and general accounting tasks, tax attorneys bring a deeper legal dimension to handling more intricate tax-related legal issues such as audits, disputes, and litigation with tax authorities.

Benefits of Tax Attorneys vs CPAs

Tax attorneys possess an in-depth understanding of complex tax laws, including federal and state tax codes, that can be invaluable to small businesses. This expertise allows them to provide tailored advice that aligns with each jurisdiction’s specific legal framework, a service that CPAs may not be able to offer.

With their deep understanding of the law, tax attorneys proactively identify specific provisions and new legal precedents that can affect your business’s tax responsibilities and opportunities for tax relief. They handle the legal documentation and procedural requirements for transactions, mergers, and acquisitions, ensuring that all tax implications are considered and addressed, instilling optimism about your business’s financial future.

In terms of financial planning, tax attorneys contribute significantly to a business’s bottom line through strategic tax planning. By assessing a company’s business structure, financial transactions, and future goals, they can devise tax strategies that reduce overall tax liabilities while ensuring full compliance with the law. This ensures your business is on the right side of the law and gives you a competitive edge, as you can take advantage of tax credits and deductions that are less known or underutilized by general accountants.

In the unfortunate event of tax audits, disputes, or litigation, having a tax attorney provides a shield of protection. They offer expert legal representation, defending your business’s interests and negotiating with tax authorities. This prevents costly penalties and fines and mitigates the risk of more severe consequences, such as criminal charges related to tax issues, reassuring you about potential risks.

Services Provided by Tax Attorneys

Services Provided by Tax Attorneys

At Todd S. Unger, Esq., LLC, our tax attorneys deliver services that cover the entire spectrum of a business’s lifecycle, from inception through ongoing operations.

Below, we detail some of the services we provide:

Business Formation and Legal Documentation

- Incorporation Assistance: We help you select the appropriate corporate structure, prepare and file all necessary incorporation documents, and draft bylaws.

- Trademark Procurement: Our team aids in securing trademarks to protect your business identity legally.

- Lease Negotiations: We negotiate lease agreements to secure favorable terms that protect your business interests and budget.

- Contract Reviews: We meticulously review contracts with vendors, clients, and employees to ensure they are legally sound and aligned with your business objectives.

Ongoing Compliance and Planning

- Strategic Tax Planning: Our attorneys develop tailored strategies to minimize your tax liabilities and fully utilize available tax laws.

- Quarterly Payments Guidance: We guide you on making accurate estimated tax payments to avoid penalties.

- Regulatory Compliance: We keep your business updated and compliant with the latest changes in tax laws, impacting your operations and financial planning.

- Audit Representation: Should you face an audit, our team provides expert support and representation, ensuring your business is well-prepared and defended.

Choosing the Right Business Structure

Tax attorneys are instrumental in guiding business owners through this decision-making process. They assess the business’s specific needs and goals, considering factors such as liability, taxation, and the ease of ongoing administration.

For example, they can help determine whether an LLC, which offers protection against personal liability and pass-through taxation, or a corporation, which is beneficial for raising capital but comes with more stringent regulatory requirements, is more suitable.

Preventive Measures and Risk Management

Preventive Measures and Risk Management

By ensuring that businesses remain compliant with tax laws and regulations, tax lawyers help avoid the triggers that lead to IRS audits and penalties. This includes record-keeping, timely tax filing, and accurate tax payment calculations.

Additionally, tax attorneys develop asset protection strategies to safeguard a business’s assets in the event of IRS action. This can involve setting up appropriate business structures, such as LLCs or asset protection trusts, that offer legal barriers against seizures.

In cases where the IRS does take action, tax attorneys are vital in crisis management. They negotiate with tax authorities to resolve disputes and prevent disruptive consequences for the business.

How to Find a Tax Attorney

When looking for a tax attorney, consider their qualifications, experience, and ability to communicate complex legal concepts.

Here’s a brief step-by-step guide on how to find and choose a tax attorney:

- Identify Your Needs: Determine what you need from a tax attorney, whether it’s help with business formation, ongoing tax planning, or representation in a dispute with the IRS.

- Research Qualifications: Look for attorneys licensed to practice in your state and have specific education or credentials in tax law, such as an LL.M. in Taxation.

- Check Experience: Assess their experience by looking at the types of clients they have worked with and cases they have handled, especially those similar to your business situation.

- Schedule Consultations: Meet with potential attorneys to discuss your needs and gauge their expertise. Prepare a list of questions about their approach to handling tax issues, their familiarity with your industry, and their strategy for tax planning.

- Assess Compatibility: Choose an attorney whose communication style and approach fit well with your expectations and business philosophy.

- Verify Reputation: Check reviews or ask for references to get an idea of the attorney’s reputation and the satisfaction of past clients.

Tax Attorney vs. CPA

Tax Attorney vs. CPA

Complicated tax issues require specialized legal expertise beyond basic financial management. Unlike CPAs, who are essential for everyday accounting and tax preparation, tax attorneys like us provide in-depth legal knowledge crucial for complex compliance, strategic tax planning, and robust defense in disputes with tax authorities.

If you’re facing tax challenges or looking to maximize your tax benefits, we partner with us. Contact Todd S. Unger now! (877) 544-4743