Your Escape Plan from Unfair IRS Debt

Innocent Spouse Relief serves as a crucial provision within U.S. tax law, designed to protect individuals from being unfairly held liable for tax discrepancies arising from their spouse’s or former spouse’s errors on jointly filed tax returns.

This relief acknowledges that one partner may not have knowledge of the other’s financial misstatements, whether through unreported income, improper deductions, or other inaccuracies, thus offering a pathway to avoid penalties and debts they did not cause. Introduced to address the growing recognition of financial abuse and the complexities of joint tax liabilities, the provision has evolved since its inception, reflecting changes in societal attitudes towards marriage, divorce, and financial responsibility.

It stands as a testament to the IRS’s commitment to equitable treatment, allowing those unwittingly entangled in tax issues due to their spouse’s actions a chance to rectify their situation without bearing undue burden.

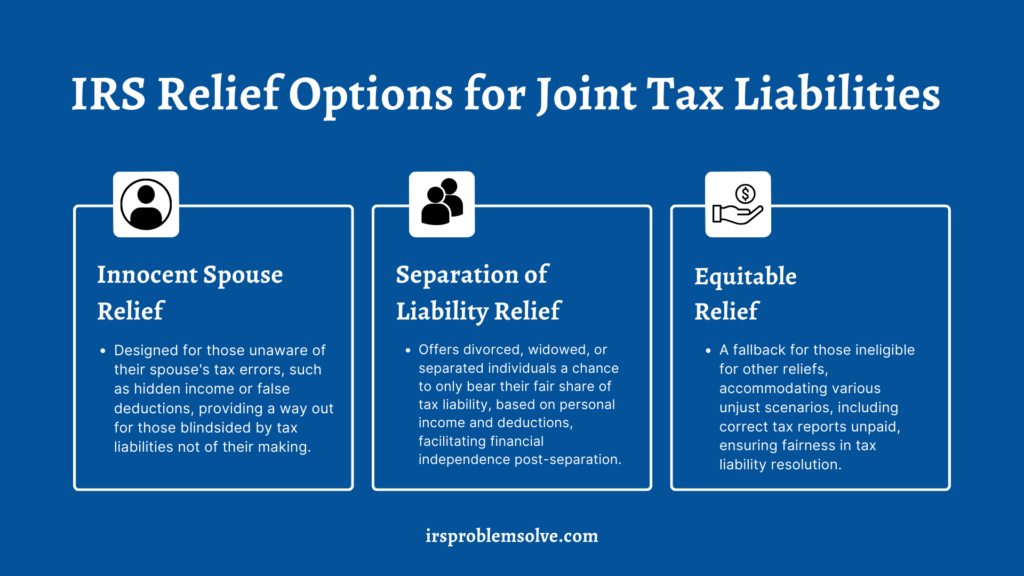

Types of Relief Available

The IRS recognizes that not all tax liabilities should fall squarely on both shoulders of those who file joint tax returns, especially when discrepancies arise from one spouse’s actions without the other’s knowledge or consent.

To address this, it offers tailored solutions through three distinct types of relief, each designed to meet the needs of individuals in different situations:

- Innocent Spouse Relief: This relief targets individuals who find themselves blindsided by a tax understatement directly linked to their spouse’s misreporting, such as unreported income or inflated deductions. Applicants must prove they were unaware of the discrepancies when they signed the joint return. This option is particularly valuable in cases where one spouse might have concealed financial information, leaving the other spouse unfairly exposed to tax liabilities. It underscores the principle that individuals should not be penalized for errors they did not commit and had no knowledge of.

- Separation of Liability Relief: Catering to those who have since divorced, become widowed, or legally separated from the spouse with whom they filed the joint return, this relief divides the tax liability between the two parties, correlating directly to each person’s income, assets, or deductions. It’s an essential provision for individuals seeking to financially extricate themselves from their former spouse, ensuring they are only held accountable for the tax debt that is rightfully theirs. This type of relief is especially pertinent in situations where the marriage has dissolved, and individuals are looking to establish their financial independence and responsibility.

- Equitable Relief: When individuals do not qualify for Innocent Spouse Relief or Separation of Liability Relief, they may still have recourse through Equitable Relief. This option is available for a wide array of situations where holding the applicant responsible for the tax liability would be unfair or unjust. It could apply in cases of underreported income or incorrect deductions, as well as scenarios where the tax was reported correctly, but not paid. Equitable Relief is the safety net for those who fall through the cracks of the other two types of relief, ensuring that the IRS can administer justice in a flexible and fair manner, based on the unique circumstances of each case.

Eligibility Criteria for Innocent Spouse Relief

Eligibility Criteria for Innocent Spouse Relief

To qualify for Innocent Spouse Relief, individuals must meet specific criteria: they must have filed a joint tax return which includes an understatement of tax due to erroneous items such as unreported income, incorrect deductions, or credits solely attributable to their spouse; be able to prove they were unaware of the errors when signing the return; and demonstrate that it would be unjust to hold them liable for the tax understatement.

Scenarios where this relief might apply include cases where one spouse concealed income from the other, claimed false deductions without the other’s knowledge, or otherwise engaged in financial deception affecting the accuracy of the joint tax return. The aim is to protect individuals who were genuinely unaware of their spouse’s wrongful financial actions, ensuring they are not penalized for mistakes they did not commit.

The Application Process

Applying for Innocent Spouse Relief is a relatively simple process, provided you take the time to fill out the forms completely and accurately. Here’s a brief step-by-step guide for you to follow:

- Submit IRS Form 8857, “Request for Innocent Spouse Relief,” immediately upon recognizing a tax liability you believe should not be your responsibility.

- Include a detailed explanation of your situation and any supporting documents with the form, such as evidence of financial abuse or proof of unawareness regarding the tax understatement, but do not attach the joint tax return.

- Ensure the application is filed within two years from when the IRS first started its collection efforts on the tax debt.

- After submitting Form 8857, the IRS will inform your spouse or ex-spouse about the submission, allowing them to be involved in the process.

- The review of your application by the IRS may take up to 6 months; during this time, continue to meet any other tax obligations.

- Filing Form 8857 is a crucial step as it formally initiates your request for relief, which, depending on the IRS’s evaluation, could absolve you from the disputed tax debt.

How A Tax Lawyer Can Help

How A Tax Lawyer Can Help

Seeking the assistance of a tax professional or attorney is advisable as soon as one becomes aware of potential tax liabilities that might qualify for Innocent Spouse Relief, especially given the complexities of tax law and the IRS’s stringent requirements.

A skilled professional can significantly improve the chances of obtaining relief by navigating the intricacies of the application process, advising on the necessary documentation, and crafting a persuasive argument that clearly demonstrates the applicant’s eligibility under the IRS criteria. Their expertise not only ensures that all procedural deadlines are met and forms correctly filed but also provides strategic advice on addressing the burden of proof and the “knowledge” clause, which are pivotal to a successful claim.

Moreover, a tax professional’s experience with similar cases offers a tactical advantage, providing insight into the IRS’s decision-making processes and potential precedents that could influence the outcome of an application.

Let Us Help

We’re here to guide you through every step of the process, ensuring you understand your rights and options. If you’re grappling with tax liabilities that you believe shouldn’t be yours to bear, let us help you find the best path forward. Our expertise in tax law means we’re uniquely equipped to advocate on your behalf, aiming to secure the relief and peace of mind you deserve. Don’t let confusion or uncertainty hold you back.

Contact us today for a consultation, and let’s take the first step towards resolving your tax concerns together.