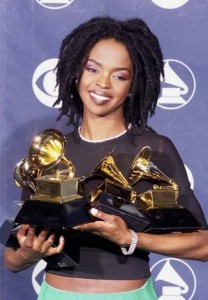

I’m sorry Lauryn Hill, but even people that live “underground” pay taxes. I’m referring to Lauryn Hill’s excuse to not file her tax returns because she was claiming to live “underground.” You never saw Jim Henson’s Fraggles in hot water with the IRS because, despite living underground, Fraggles filed their tax returns timely.

I’m sorry Lauryn Hill, but even people that live “underground” pay taxes. I’m referring to Lauryn Hill’s excuse to not file her tax returns because she was claiming to live “underground.” You never saw Jim Henson’s Fraggles in hot water with the IRS because, despite living underground, Fraggles filed their tax returns timely.

The former Fugees member has been charged with three counts of misdemeanor failure to file taxes from 2005 to 2007 on nearly $1.6 million in earnings.

Under the tax code, the elements to successfully prosecute Lauryn Hill of willfully failing to file an income tax return, misdemeanor are (1) Willfulness; (2) Requirement to file a return, pay a tax, maintain records, or supply information; and (3) Failure to file a return, pay an estimated tax or tax, maintain records, or supply information.

Each of the counts carries a possible sentence of one year in prison plus a $100,000 fine. Hill will appear in a Newark, New Jersey court after being charged by the U.S. Justice Department. In cases where an overt act of evasion occurred, willful failure to file may be elevated to Tax Evasion, a felony.

The civil penalty for the failure to file is 5% of the net tax due for each month or part of a month the return is late. The maximum penalty that can be assessed for late filing penalty is 25% of the net tax due. In the case of fraudulent failure to file, the penalty amount for each month is 15% of the net tax due, and the maximum penalty that can be assessed is 75% of the tax. Normally, the fraudulent failure to file penalty is assessed against taxpayers who did not file in an attempt to evade tax.

If you have years of unfiled tax returns and need immediate assistance, the please contact Tax Attorney, Todd S. Unger, Esq. for a confidential consultation.